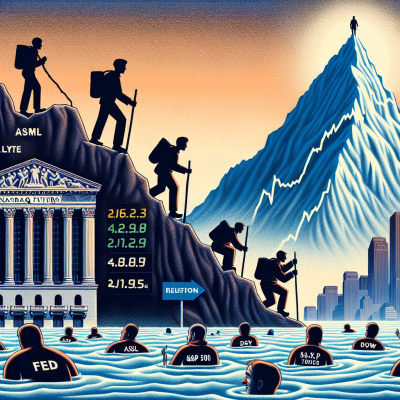

The financial world is once again bracing for significant developments, as favorable reports from tech powerhouse ASML inject optimism into the Nasdaq, ahead of pivotal decisions by the Federal Reserve. Meanwhile, the S&P 500 and Dow Jones Industrial Average remain steady, signaling investor caution. Let’s dive into the key highlights shaping the stock market today.

ASML Steals the Spotlight: A Boon for Tech Stocks

ASML Holding NV, a semiconductor equipment giant, has emerged as the highlight of the day, with its solid quarterly earnings and robust orders driving a surge in investor confidence. As the global chip industry struggles to meet growing demand, ASML’s outlook suggests a rebound in tech manufacturing and innovation.

Why ASML’s Success Matters

ASML’s optimistic earnings report is not just a win for the company but also a barometer for the broader tech industry. Here’s why:

- Tech Reliance on Semiconductors: The demand for advanced semiconductors spans across sectors like artificial intelligence, automotive, and consumer electronics, making ASML’s performance critical to multiple industries.

- Market Sentiment: Positive developments in key tech companies like ASML can serve as a harbinger of strength for the Nasdaq Composite Index.

- Global Supply Chain Pulse: ASML’s order book provides a peek into the health of global supply chains and end-user demand in a tightly linked semiconductor ecosystem.

Federal Reserve Decision Looms: A Pivotal Moment for Markets

While tech stocks rally on ASML’s upbeat report, Wall Street remains fixated on the Federal Reserve’s upcoming interest rate decision. Investors are weighing the potential impacts of monetary policy adjustments amid persistent economic uncertainties.

What to Watch in the Fed Meeting

The Fed’s decision will set the tone for the financial markets in the coming weeks. Key areas to monitor include:

- Interest Rate Forecasts: Will the Fed continue signaling its hawkish stance, or will signs of cooling inflation prompt a pause in rate hikes?

- Statement Language: Market participants will be scrutinizing the central bank’s language on inflation and employment trends to gauge the direction of future policy shifts.

- Economic Impact: Higher rates have already pressured sectors like housing and consumer spending. A further hike could create additional headwinds.

Whether the Fed adopts a “wait-and-see” approach or opts for immediate action, its policy declarations will likely alter the landscape for bonds, equities, and even the foreign exchange market.

S&P 500 and Dow Hold Steady: Investor Patience on Display

In contrast to the tech-centric Nasdaq, the S&P 500 and Dow Jones indices have remained relatively quiet. The cautious sentiment reflects the broader market waiting for catalysts in the form of Federal Reserve decisions and Big Tech earnings.

Firms Leading the Charge

Investors will have their eyes on upcoming earnings reports from major players, including:

- Alphabet (Google): With the rise of AI and shifting ad-revenue models, Google’s metrics could provide insights into broader sector trends.

- Amazon: E-commerce performance and cloud revenue will likely take center stage during Amazon’s earnings announcement.

- Apple: Staying under a global supply chain microscope, Apple’s guidance will surely capture significant investor attention.

The Role of Earnings Season: What’s at Stake?

The first batch of Big Tech earnings is expected to set the stage for the rest of the earnings season. As these companies dominate the indices, their performance often dictates the rhythm of the broader market. Here are some critical themes to watch:

- Big Tech Leadership: Market trends often follow the fortunes of tech giants. A strong performance among key players could buoy risk sentiment.

- Macro Challenges: Companies facing challenges like inflationary pressures, rising labor costs, or muted consumer spending could weigh on market dynamics.

- Guidance Over Numbers: Forward-looking statements could be more impactful than past performance, as analysts and investors assess growth potential.

Takeaway: Optimism Meets Caution

As today’s market action unfolds, a clear dichotomy is emerging. Enthusiasm around ASML’s strong earnings and the resulting Nasdaq futures rise underscores optimism in the technology sector. However, this exuberance is tempered by collective caution ahead of the Federal Reserve’s policy decision and the start of Big Tech earnings season.

For investors, the key will be striking a balance between capitalizing on short-term opportunities in tech and hedging against potential market volatility from Fed actions and earnings surprises. In the coming days, the financial narrative will grow clearer as more data and metrics emerge.

Stay tuned for further updates as this dynamic market week progresses.

Leave a Reply