ASML Holding, the global leader in advanced lithography equipment, has once again demonstrated its dominance in the semiconductor industry. For the fourth quarter of 2024, the company not only surpassed Wall Street expectations but also provided a strong outlook for the current period. Following the news, ASML stock surged, reflecting investor confidence in the company’s performance and future growth prospects. Here’s a detailed breakdown of ASML’s earnings, guidance, and what it means for both the company and the semiconductor sector.

ASML’s Stellar Q4 2024 Earnings Report

In Q4 2024, ASML delivered a robust performance, managing to beat analyst projections across key financial metrics. The Dutch chip-equipment maker has maintained its position as the cornerstone of the semiconductor machinery market, driven largely by strong demand across a variety of sectors, including artificial intelligence (AI), 5G, and next-generation computing.

Key Highlights From the Earnings Call

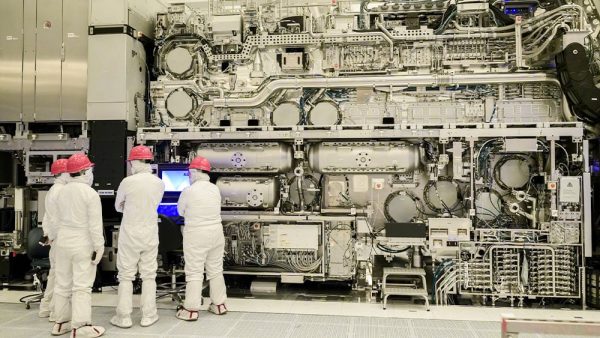

- Revenue: ASML reported quarterly revenue that exceeded analyst forecasts, buoyed by a healthy order pipeline and strong demand for its extreme ultraviolet (EUV) lithography systems, which are critical to advanced chip manufacturing.

- Earnings Per Share (EPS): The company’s EPS also came in above market estimates, showcasing its operational efficiency amid high-volume production.

- Orders & Backlog: ASML continues to see robust bookings, with a growing backlog of orders from semiconductor giants such as Intel, TSMC, and Samsung.

Market Reaction: A Boost for ASML Stock

Following the earnings announcement, ASML stock rose substantially, signaling optimism among investors. The better-than-expected numbers and upbeat guidance provided a bullish signal for the company’s long-term prospects, reinforcing its reputation as an essential player in the semiconductor supply chain.

Guidance for Q1 2025: Setting High Expectations

In addition to its impressive Q4 results, ASML offered an optimistic outlook for the first quarter of 2025. Management guided above analysts’ estimates for both revenue and operating margins, highlighting the company’s strong momentum heading into the new year. This forecast was driven by ongoing demand for EUV lithography systems, as the semiconductor industry continues to transition to smaller, more powerful chips.

Drivers Behind ASML’s Growth

- Technological Leadership: ASML’s high-NA (numerical aperture) EUV lithography systems represent the cutting edge of chip manufacturing technology. These tools are essential for producing advanced semiconductors required for AI, autonomous vehicles, and high-performance computing.

- Resilient Demand: Despite concerns of a cyclical slowdown in the semiconductor industry earlier in 2024, ASML continued to capture strong demand, particularly from leading chipmakers looking to future-proof their manufacturing capabilities.

- Global Trends: Innovations in AI, cloud computing, and connectivity are spurring unprecedented demand for high-performance semiconductors, positioning ASML as a critical enabler of these technologies.

What Analysts Are Saying

The strong guidance and earnings beat have garnered praise from analysts, who view ASML as a bellwether for the semiconductor industry. Many expect ASML to maintain its upward trajectory as the global push for advanced manufacturing technologies deepens. Some analysts have even raised their price targets on ASML following the earnings announcement.

ASML: A Cornerstone of the Semiconductor Revolution

ASML’s dominant market position and cutting-edge technology have made it a linchpin of the semiconductor revolution. As the global economy becomes increasingly reliant on advanced chips, ASML’s role will only become more critical. With its latest earnings results, the company has underscored its ability to navigate industry challenges while delivering value to shareholders.

What Lies Ahead for ASML

- Continued Innovation: ASML will likely remain the go-to provider of advanced lithography systems, with ongoing R&D investments ensuring its technological edge.

- Expanding Market Share: As chipmakers ramp up production to meet growing demand, ASML could see increased orders for its EUV systems, particularly in emerging markets.

- Focus on Sustainability: Amid growing concerns about the environmental impact of chip manufacturing, ASML is also focusing on developing energy-efficient solutions for its clients.

Conclusion: ASML’s Bright Future

ASML’s exceptional Q4 performance and optimistic guidance for 2025 reaffirm its position as a cornerstone of the semiconductor industry. As the world continues to demand more advanced technologies, ASML’s products will remain indispensable for chipmakers globally. With a strong growth trajectory and investor confidence, the company is well-poised to capitalize on emerging trends in the years to come.

For investors and tech enthusiasts alike, ASML is a name to watch as it continues to define the future of semiconductor manufacturing and power the next generation of innovation.

Leave a Reply