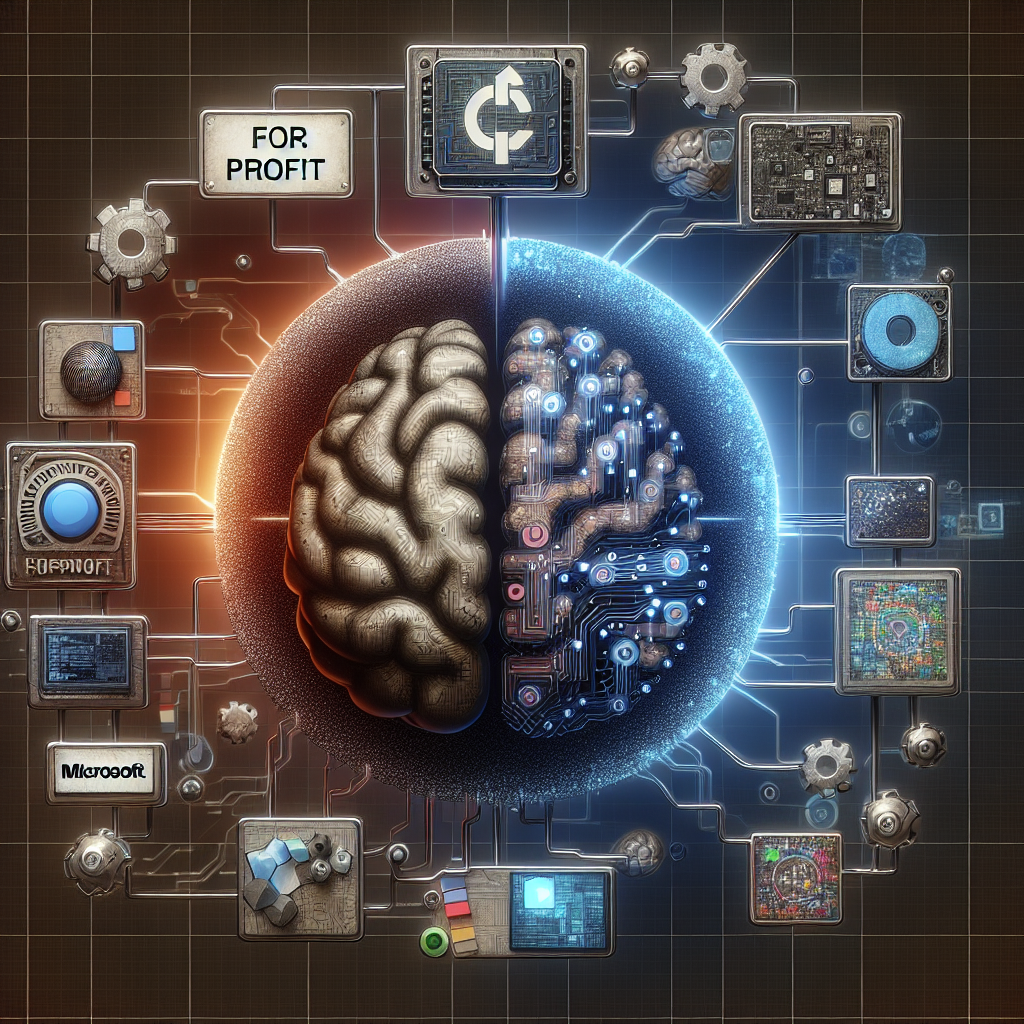

OpenAI’s Major Structural Shift: A New For-Profit Era with Microsoft at the Helm

In a landmark development reshaping the artificial intelligence landscape, OpenAI has announced a significant restructuring that includes the formation of a new for-profit entity called OpenAI Group PBC. This transformation marks one of the most pivotal moments in the organization’s history, signaling a strategic evolution from its mission-driven roots to a more commercially-oriented model. Most notably, tech giant Microsoft is set to acquire a substantial 27% stake in the newly-structured for-profit company.

Understanding the Shift: From Non-Profit to For-Profit Public Benefit Corporation

Since its founding in 2015, OpenAI has oscillated between public interest and private investment. Originally established as a nonprofit research laboratory, OpenAI’s goal was to ensure the safe and equitable distribution of artificial general intelligence (AGI). However, the journey hasn’t been linear.

In 2019, OpenAI already began hinting at a shift when it introduced a “capped-profit” model, allowing for investor returns while still prioritizing its mission. Now, with the creation of OpenAI Group PBC, the company is taking its boldest step yet into the commercial domain by forming this new for-profit layer under its nonprofit parent.

Why the Reorganization Now?

The AI arms race is heating up, and OpenAI is one of its key players. Building and deploying advanced AI tools like ChatGPT, DALL·E, and Codex require enormous computational resources and substantial funding. A for-profit arm gives OpenAI the agility to:

- Attract top-tier investment and talent

- Scale products and services more rapidly

- Negotiate strategic partnerships more fluidly

- Compete with Google DeepMind, Anthropic, and other AI-first firms

By aligning more closely with the financial motivations of its partners, notably Microsoft, OpenAI aims to speed up product development without losing sight of its ethical foundation—a balance made possible by its public benefit designation.

Microsoft’s 27% Stake: What It Means

Microsoft has been a steadfast supporter of OpenAI since its early pivot towards commercialization. From multi-billion dollar investments to integrating AI across its entire product suite, Microsoft and OpenAI have become increasingly interdependent.

With the latest restructuring, Microsoft is set to hold approximately 27% equity in OpenAI Group PBC. This move not only reinforces their technical and strategic collaboration but also increases Microsoft’s influence on the direction of some of today’s most advanced AI technologies. Analysts expect this will further integrate OpenAI’s tools into the Microsoft ecosystem—particularly across Azure, Microsoft Teams, Word, Excel, and more.

Strategic Benefits for Microsoft

By embedding itself deeper into OpenAI’s operations, Microsoft gains:

- Preferred access to OpenAI’s cutting-edge models and research outputs

- Enhanced brand equity as a leader in next-gen AI technology

- A powerful economic stake in the future of general-purpose AI

Public Benefit Corporation Status: Safeguarding the Mission

One critical facet of the new structure is the designation of OpenAI Group PBC as a Public Benefit Corporation (PBC). A PBC is a legal classification that adds an additional layer of accountability: balancing profit-making with positive societal impact. This aims to reassure stakeholders and the public that OpenAI won’t abandon its foundational mission in pursuit of unchecked profits.

Mission vs. Monetization

There were rising concerns that OpenAI’s increasing commercialization could risk mission drift. By adopting the PBC framework, OpenAI intends to enshrine its research ethics and principles—like transparency, AI safety, and fairness—within its new business-oriented goals.

This delicate balance is crucial as the world becomes ever more dependent on AI solutions across critical sectors such as healthcare, education, finance, and law.

What This Means for the AI Landscape

OpenAI’s restructuring carries broader implications across the technology and investment sectors. It signals an accelerating trend toward the commercialization of foundational AI technologies. As AI continues to outpace regulatory and ethical frameworks, OpenAI’s pivot could serve as both a cautionary tale and a scalable model for future innovation hybridized with mission-driven oversight.

Potential Ripple Effects

- Other AI labs may follow suit, balancing nonprofit missions with for-profit subsidiaries

- Investors might take renewed interest in ethical AI startups poised for commercialization

- Governments and regulators may examine such transitions more closely to ensure alignment with public interest

Looking Ahead: What’s Next for OpenAI?

As OpenAI embraces this new chapter under OpenAI Group PBC, industry watchers will be closely monitoring whether this transformation enhances or hinders the company’s original mission. Microsoft’s deeper involvement certainly provides stability and capital, enabling rapid innovation. However, maintaining ethical oversight amid increased financial stakes will be an ongoing challenge.

Key Questions Moving Forward

- Can OpenAI remain mission-aligned in an increasingly commercial role?

- Will Microsoft’s ownership stake influence product development and deployment decisions?

- How will the public and regulators respond to the deeper entwinement between Big Tech and fundamental AI research?

Final Thoughts

OpenAI’s evolution into a for-profit entity marks a turning point not just for the company, but for the AI industry as a whole. With Microsoft’s 27% stake, the new structure offers promise in terms of innovation, scalability, and commercial viability—while also placing a heavy responsibility on both organizations to ensure AI development remains ethically grounded and equitably distributed.

As this new for-profit model unfolds, the world will be watching to see if OpenAI can successfully straddle the line between financial ambition and public accountability.

Leave a Reply