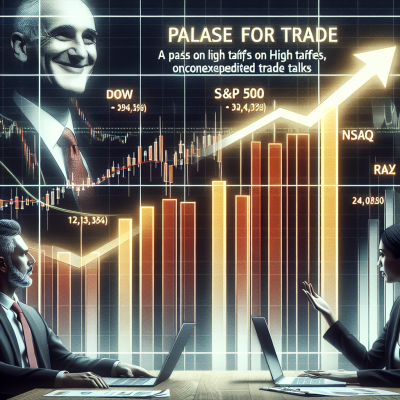

Stocks Leap as US-EU Trade Tensions Ease

In a pivotal move that fueled investor optimism and spurred a major market rally, President Trump has announced a pause on proposed 50% tariff hikes on European Union imports. The decision, which signals a willingness to engage in fast-tracked trade negotiations with the EU, sent U.S. stocks soaring across the board on Thursday.

Market Surge Reflects Investor Relief

All three major U.S. indices closed significantly higher, with the Dow Jones Industrial Average rising over 500 points, the S&P 500 gaining more than 1.5%, and the Nasdaq Composite climbing above 2%. This sharp rebound reflects growing optimism that a broader trade agreement between the U.S. and EU may be on the horizon.

- Dow Jones: +1.4%

- S&P 500: +1.6%

- Nasdaq: +2.1%

Tech, Industrials, and Auto Stocks Rally

Sectors with high exposure to global trade responded most positively:

- Technology stocks led gains, with semiconductor companies like Nvidia and AMD posting impressive intraday rallies.

- Industrial giants such as Caterpillar and Boeing surged on hopes for resumed demand and supply chain stability.

- Automakers, including Ford and General Motors, gained after the announcement delayed punitive tariffs that would have impacted cross-border manufacturing.

Trump’s Pivot Signals Willingness to Negotiate

President Trump’s decision to hold off on the increased tariffs comes after escalating tensions over digital services taxes and aerospace subsidies. According to a senior White House official, the administration is “committed to finding common ground with the European Union and accelerating talks.”

Many analysts believe the pause in tariffs was a strategic maneuver aimed at opening the door for constructive dialogue. Some key points that both parties are expected to address in upcoming negotiations include:

- Digital services taxation frameworks

- Leveling the playing field in agriculture and manufacturing

- Technological cooperation and competition standards

Why This Matters for Markets

Trade wars and protectionist policies have weighed heavily on market sentiment over the past few years. Tariffs, in particular, create uncertainty in supply chains, increase input costs for companies, and can stifle consumer spending. A thawing of tensions between two of the world’s largest trading blocs could pave the way for more stability in global commerce.

Global Investors Take Cue from Washington

Equity markets in Europe also responded favorably. The German DAX and the French CAC both shot up as hopes surged that exporters will avoid steep U.S. tariffs. This cross-continental rally indicates that the impact of Trump’s announcement spans beyond U.S. shores.

Experts Weigh In

Market strategists and economists have largely welcomed the news, citing it as a necessary de-escalation at a time when global economic indicators are showing signs of softening.

“This move gives businesses on both sides of the Atlantic some much-needed breathing room,” said Claire Rodriguez, Senior Analyst at GlobalTrade Insights. “It signals that dialogue—and perhaps compromise—is not off the table, which is ultimately good for market stability.”

Next Steps: Can a Deal Be Reached?

While the pause is seen as a constructive gesture, much remains to be done. Negotiators from both the U.S. and EU will be working quickly to capitalize on this momentum. Any long-term trade agreement between Washington and Brussels would need to address deep-seated differences in data privacy, environmental standards, and subsidy regimes.

Upcoming Talks Could Reshape Transatlantic Trade

Both parties have hinted at a potential bilateral economic agreement that could streamline digital commerce, increase capital flows, and reduce dependency on tariffs. If successful, this could mark the first major re-shaping of U.S.-EU trade relations in decades.

Conclusion: A Market Rebound Pinned on Diplomacy

In a time of geopolitical friction and economic uncertainty, Thursday’s market rally provided a reminder of how powerful positive diplomatic signals can be for financial markets. As negotiations ramp up, investors will be closely watching every development, with hopes that this tariff pause is a sign of a more collaborative future.

Stay tuned as this story develops—markets and policymakers alike are waiting to see if this new wave of optimism translates into tangible trade outcomes.

Leave a Reply